Before The Crypt: The Untold Journey Of Cryptocurrency Beginnings

Before the crypt was just a buzzword, it was a groundbreaking idea that would change the world. The world of finance, technology, and even how we view money itself was about to get a major shake-up. We're talking about the early days, the wild west of digital currencies, where visionaries and geeks came together to create something truly revolutionary. If you think crypto is just about Bitcoin and Ethereum today, you ain't seen nothing yet.

Before the crypt, there was a lot of skepticism. People were like, "Digital money? Are you serious?" But here's the thing—those who believed in the potential of blockchain and decentralized systems saw it as more than just a financial experiment. It was about freedom, transparency, and empowerment. And trust me, the journey wasn't smooth. There were bumps, scandals, and even a few outright failures. But hey, every great story has its twists, right?

This article dives deep into the pre-crypto era, uncovering the origins, key players, and the mind-blowing events that led to the birth of what we now call the cryptosphere. So, whether you're a seasoned crypto enthusiast or just curious about how it all started, buckle up. This is gonna be a wild ride.

Read also:Pit Stop Clothing Your Ultimate Fashion Destination

Table of Contents

- The Early Days of Digital Currencies

- Key Players Before the Crypt

- The Concept of B-Money

- Hashcash: The Precursor to Bitcoin

- Satoshi Nakamoto: The Mysterious Genius

- The Bitcoin Whitepaper: A Game-Changer

- Blockchain Technology: The Backbone of Cryptocurrency

- The First Bitcoin Transactions

- Challenges Faced Before the Crypt

- The Future of Cryptocurrency

The Early Days of Digital Currencies

So, let's rewind a bit. Before the crypt became a household name, there were a bunch of attempts to create digital currencies. Think of it like a bunch of pioneers trying to build the first airplane. Some crashed, some barely flew, but each one taught us something valuable. In the late '80s and '90s, there were projects like DigiCash and e-gold that tried to tackle the digital currency challenge. These projects had their own set of problems, like centralization and trust issues, but they laid the groundwork for what was to come.

One of the biggest hurdles was the double-spending problem. You know, like when someone tries to spend the same digital coin twice. It was a real pain in the neck, and no one had figured out a foolproof way to solve it. But these early attempts showed us that there was a demand for a digital currency that could be trusted and used globally.

Why Digital Currencies Were Needed

Here's the deal: traditional banking systems were great, but they had their flaws. High transaction fees, slow processing times, and the need for intermediaries made people look for alternatives. Digital currencies promised to cut out the middleman, reduce costs, and make transactions faster and more efficient. Plus, with the rise of the internet, the world was becoming more connected, and people wanted a currency that could keep up with the digital age.

Key Players Before the Crypt

Now, let's talk about the key players in the pre-crypto era. There were some really smart folks who laid the foundation for what we have today. People like David Chaum, the creator of DigiCash, and Nick Szabo, who came up with the concept of smart contracts. These guys weren't just dreaming; they were building the tools and technologies that would eventually lead to the creation of Bitcoin and other cryptocurrencies.

And let's not forget the cypherpunks. This was a group of privacy advocates and crypto enthusiasts who believed in the power of cryptography to protect individual freedoms. They were like the rebels of the digital world, fighting against government surveillance and corporate control. Their ideas and technologies played a crucial role in shaping the future of cryptocurrency.

Who Were the Cypherpunks?

The cypherpunks were a diverse group of individuals who shared a common vision. They believed in the power of cryptography to create a more free and open society. Some of them were academics, others were hackers, and a few were just curious tinkerers. They communicated through mailing lists and online forums, sharing ideas and collaborating on projects. Their work laid the foundation for many of the cryptographic protocols used in blockchain technology today.

Read also:Moctar In Seattle A Rising Stars Journey Through Music And Culture

The Concept of B-Money

Fast forward to 1998, and we have Wei Dai, a computer engineer who proposed the concept of b-money. B-money was an anonymous, distributed electronic cash system that used a combination of cryptography and game theory to solve the double-spending problem. It was a pretty radical idea at the time, but it showed that it was possible to create a decentralized digital currency without relying on a central authority.

B-money was never fully implemented, but it influenced many of the ideas that would later become part of Bitcoin. It introduced the concept of proof-of-work, which is a key component of the Bitcoin protocol. Proof-of-work is like a digital puzzle that miners have to solve in order to add new blocks to the blockchain. It's what makes Bitcoin secure and resistant to attacks.

How B-Money Worked

- Participants would create digital signatures to prove ownership of their coins.

- Transactions would be broadcast to the network for verification.

- Miners would solve cryptographic puzzles to add new blocks to the chain.

- The system would reward miners with newly created coins.

Hashcash: The Precursor to Bitcoin

Another important piece of the puzzle was Hashcash, created by Adam Back in 1997. Hashcash was originally designed as a way to prevent email spam by requiring senders to perform a small amount of computational work before sending an email. This idea of using computational work as a deterrent against abuse would later become a key feature of Bitcoin's proof-of-work system.

Hashcash was simple but effective. It required senders to find a partial hash collision, which was computationally expensive but easy to verify. This made it difficult for spammers to flood the network with junk emails. The same principle was later applied to Bitcoin, where miners had to solve a similar cryptographic puzzle to add new blocks to the blockchain.

Why Hashcash Was Important

Hashcash demonstrated that it was possible to use computational work as a way to secure a system. It also showed that this approach could be used to create a decentralized system that didn't rely on a central authority. These ideas were crucial in the development of Bitcoin and other cryptocurrencies. Without Hashcash, the concept of proof-of-work might never have been realized.

Satoshi Nakamoto: The Mysterious Genius

And then, out of nowhere, came Satoshi Nakamoto. No one knows who he, she, or they really are. Some say it's a group of people, others think it's an individual. But one thing's for sure—Satoshi Nakamoto is the mastermind behind Bitcoin. In 2008, Satoshi published the Bitcoin whitepaper, which outlined the design and functionality of the first decentralized digital currency.

What made Bitcoin different from previous attempts was its use of blockchain technology. Blockchain is like a digital ledger that records all transactions in a secure and transparent way. It's decentralized, meaning no single entity controls it, and it's immutable, meaning once a transaction is recorded, it can't be changed. This made Bitcoin truly revolutionary.

What We Know About Satoshi

Satoshi Nakamoto communicated with the early Bitcoin community through forums and emails. They were very knowledgeable and had a deep understanding of cryptography and economics. Satoshi disappeared from the scene in 2010, leaving the Bitcoin project in the hands of the community. Despite numerous attempts to uncover their true identity, Satoshi remains a mystery to this day.

The Bitcoin Whitepaper: A Game-Changer

The Bitcoin whitepaper was a game-changer. It was like a blueprint for the future of digital currencies. In just nine pages, Satoshi outlined how Bitcoin would work, from the proof-of-work system to the blockchain itself. It was concise, clear, and revolutionary. People in the cryptography community immediately recognized its potential and started working on implementing it.

One of the most important aspects of the whitepaper was its emphasis on decentralization. Satoshi argued that a centralized system was vulnerable to attacks and corruption. By creating a decentralized system, Bitcoin could provide a more secure and trustworthy alternative to traditional banking systems. This idea resonated with many people who were disillusioned with the current financial system.

Key Points from the Whitepaper

- Bitcoin is a peer-to-peer electronic cash system.

- It uses a proof-of-work system to prevent double-spending.

- Transactions are recorded in a blockchain, which is a distributed ledger.

- Miners are rewarded with newly created coins for securing the network.

Blockchain Technology: The Backbone of Cryptocurrency

Blockchain technology is the backbone of cryptocurrency. It's what makes Bitcoin and other digital currencies secure, transparent, and decentralized. Think of it like a digital ledger that records all transactions in a secure and immutable way. Each block in the chain contains a list of transactions, and once a block is added to the chain, it can't be altered without altering all subsequent blocks.

What makes blockchain so powerful is its ability to create trust in a trustless environment. In a traditional banking system, you have to trust the bank to keep your money safe. With blockchain, you don't need to trust anyone. The system itself ensures that all transactions are valid and secure. This has huge implications for industries beyond finance, such as supply chain management, healthcare, and voting systems.

How Blockchain Works

Here's a quick breakdown of how blockchain works:

- Transactions are grouped into blocks.

- Each block is linked to the previous block, forming a chain.

- Miners verify the transactions and add new blocks to the chain.

- The blockchain is distributed across a network of computers, making it decentralized.

The First Bitcoin Transactions

The first Bitcoin transaction took place in 2010 when a programmer named Laszlo Hanyecz bought two pizzas for 10,000 BTC. At the time, Bitcoin was worth pennies, so it wasn't a big deal. But looking back, it was a historic moment. It showed that Bitcoin could be used to buy real-world goods and services, not just as a theoretical concept.

Since then, Bitcoin has grown exponentially, with millions of people around the world using it for everything from online shopping to cross-border payments. The value of Bitcoin has also skyrocketed, making early adopters millionaires overnight. But the journey hasn't been without its challenges.

Why the First Transaction Matters

The first Bitcoin transaction demonstrated that digital currencies could be used in the real world. It was a proof-of-concept that showed Bitcoin wasn't just a theoretical idea. It also highlighted the potential of cryptocurrencies to disrupt traditional payment systems. Today, thousands of merchants accept Bitcoin and other cryptocurrencies as payment, making it a viable alternative to fiat currencies.

Challenges Faced Before the Crypt

Of course, the journey wasn't all sunshine and rainbows. There were plenty of challenges along the way. One of the biggest was the lack of adoption. In the early days, very few people understood or trusted digital currencies. It was hard to convince people to use something that seemed so abstract and unfamiliar.

Another challenge was regulation. Governments around the world were unsure how to deal with cryptocurrencies. Some saw them as a threat to their monetary systems, while others saw them as an opportunity. This led to a patchwork of regulations that varied from country to country, making it difficult for businesses and individuals to navigate the legal landscape.

Overcoming the Challenges

Despite these challenges, the crypto community persevered. Developers continued to improve the technology, making it more secure and user-friendly. Educators and advocates worked to spread awareness and understanding of cryptocurrencies. And slowly but surely, adoption began to grow. Today, cryptocurrencies are more accepted and understood than ever before.

The Future of Cryptocurrency

So, what does the future hold for cryptocurrencies? Well, it's hard to say exactly, but one thing's for sure—they're here to stay. We're seeing more and more businesses and governments exploring the potential of blockchain technology. Central banks are even considering creating

Ani B: The Rising Star In The Spotlight

Moee Baby: The Ultimate Guide To Understanding And Embracing This Viral Sensation

Texas Pie Fest: A Sweet Adventure In The Heart Of The Lone Star State

Ned Stark at the Winterfell crypts, kneeling down before the statue and

Before The Crypt YouTube

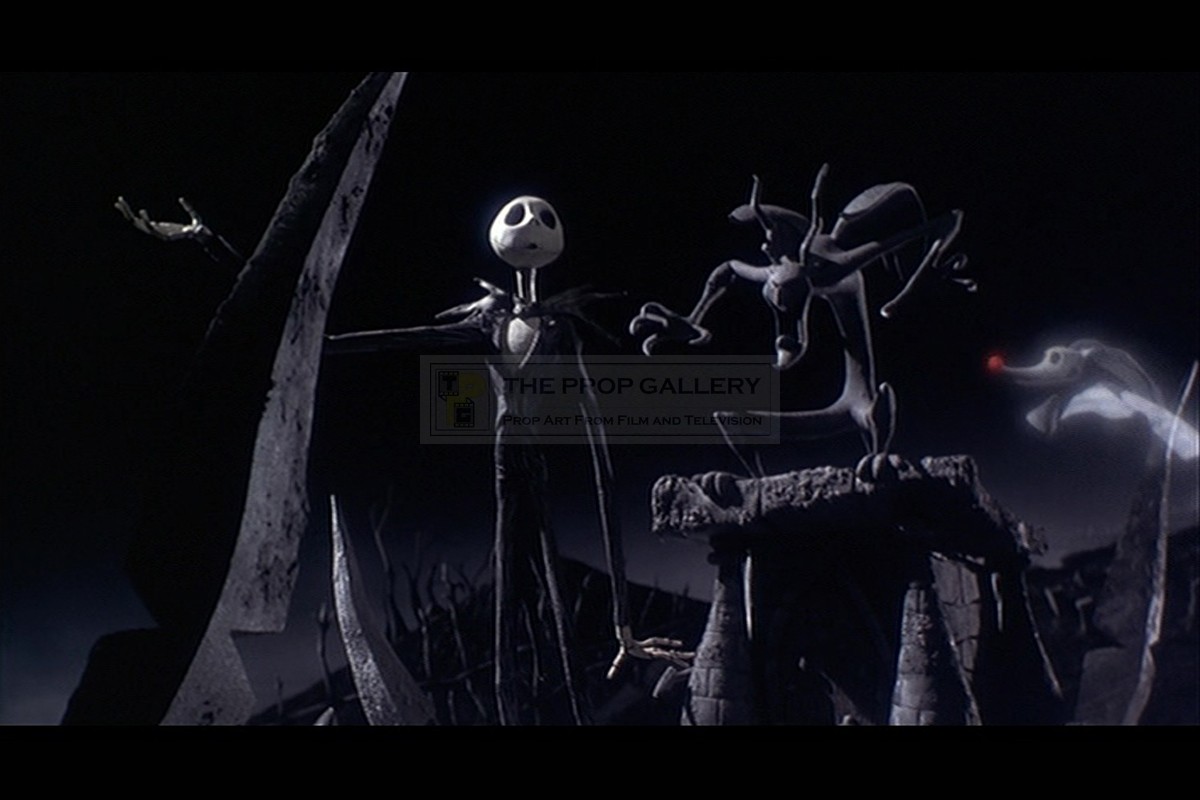

The Prop Gallery Crypt spike